How Artificial Intelligence (AI) can help advance the cause of fair lending

Challenge

FINCA Microfinance Bank is one of the largest microfinance banks in the world currently operating in more than 22 countries. In Pakistan, they offer their services in more than 85 cities and have at their disposal five savings products and six different types of loans. By 2016 the bank's overall loan portfolio in Pakistan had crossed USD 100 million.

FINCA wanted to expand its lending customer portfolio by being able to accurately predict the probability of default of an applicant and proposed a credit scoring exercise for the same. Our task was thus to develop a propriety algorithm which had an overall strong accuracy to predict the customer payback rate and aid the bank in decision making.

Solution

We used advanced statistical methods to shortlist variables that best predict default, and applied complex machine learning algorithms to build probabilistic, predictive models. Such models give a set of rules that can be used to predict default. According to an article "Tapping the Power of Machine Learning Algorithms in Scorecard Developed" published in FICO World 2016, machine learning improves the accuracy of default prediction by almost 10% when compared with traditional credit scoring models.

Result

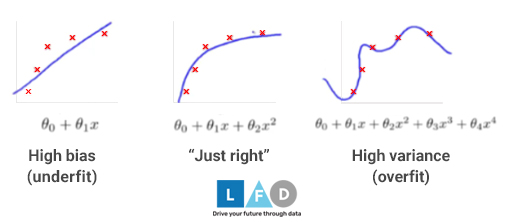

Through detailed, exhaustive analysis of the data and a systematic approach, we developed a model that was 'Just Right' versus an overfit or underfit model (the former considers outliers and noise as actual data, while the latter is too generic and does not take into consideration several important trends).

This algorithm was then trained on the data provided by the bank based on 60,000 loan applicants and it was tested on a data of 20,000 loan applicants whose payback status was hidden but some other demographic variables were revealed. It proved to have an 89% accuracy rate and hence on this basis, it was found out that the bank could increase its payback status by 75% if it gives loans to only those applicants who were predicted by the model to have the status of returning it.

Thus, we were able to provide the bank with a strong credit scoring system that was faster, more efficient and resulted in lower cost of credit analysis. Moreover, because the system was based on machine learning algorithms, it would continuously improve through the input of more data and could be easily integrated with the bank's own Loan Management System.

With our Default Prediction model, not only is customer privacy ensured since we don't need any identification data, but the need for manual intervention and chances of human error are removed, as the system works in real time and results can be provided quickly and with great accuracy.